Streamline Your WBSO Administration Simply with Traqqie

Streamline Your WBSO Administration Simply with Traqqie

Blog Article

Introduction:

Navigating with the intricacies of WBSO (Soaked Bevordering Speur- en Ontwikkelingswerk) administration might be a daunting undertaking For several corporations. From correctly documenting R&D functions to complying with stringent reporting prerequisites, running WBSO can eat worthwhile time and sources. Even so, with the correct tools and methods in place, enterprises can streamline their WBSO administration processes, conserving time and making sure compliance. Enter Traqqie – your supreme companion in simplifying WBSO administration.

What's WBSO and Why is Proper Administration Essential?

WBSO is often a tax incentive furnished by the Dutch government to encourage innovation within corporations. It provides a discount in wage tax or national coverage contributions for suitable R&D jobs. However, accessing these Advantages needs meticulous administration and adherence to certain tips established via the Dutch tax authorities. Failure to keep up appropriate WBSO administration can lead to skipped incentives, fiscal penalties, as well as audits.

The Problems of WBSO Administration:

Documentation Stress: Corporations have to maintain in-depth information in their R&D activities, together with undertaking descriptions, several hours worked, and technological advancements.

Compliance Complexity: Navigating the intricate regulations and regulations of WBSO might be too much to handle, especially for organizations with constrained experience in tax issues.

Chance of Faults: Handbook info entry and calculation improve the possibility of glitches, resulting in opportunity compliance challenges and money setbacks.

Time-Consuming Procedures: Classic methods of WBSO administration entail sizeable time and effort, diverting means from Main company pursuits.

How Traqqie Simplifies WBSO Administration:

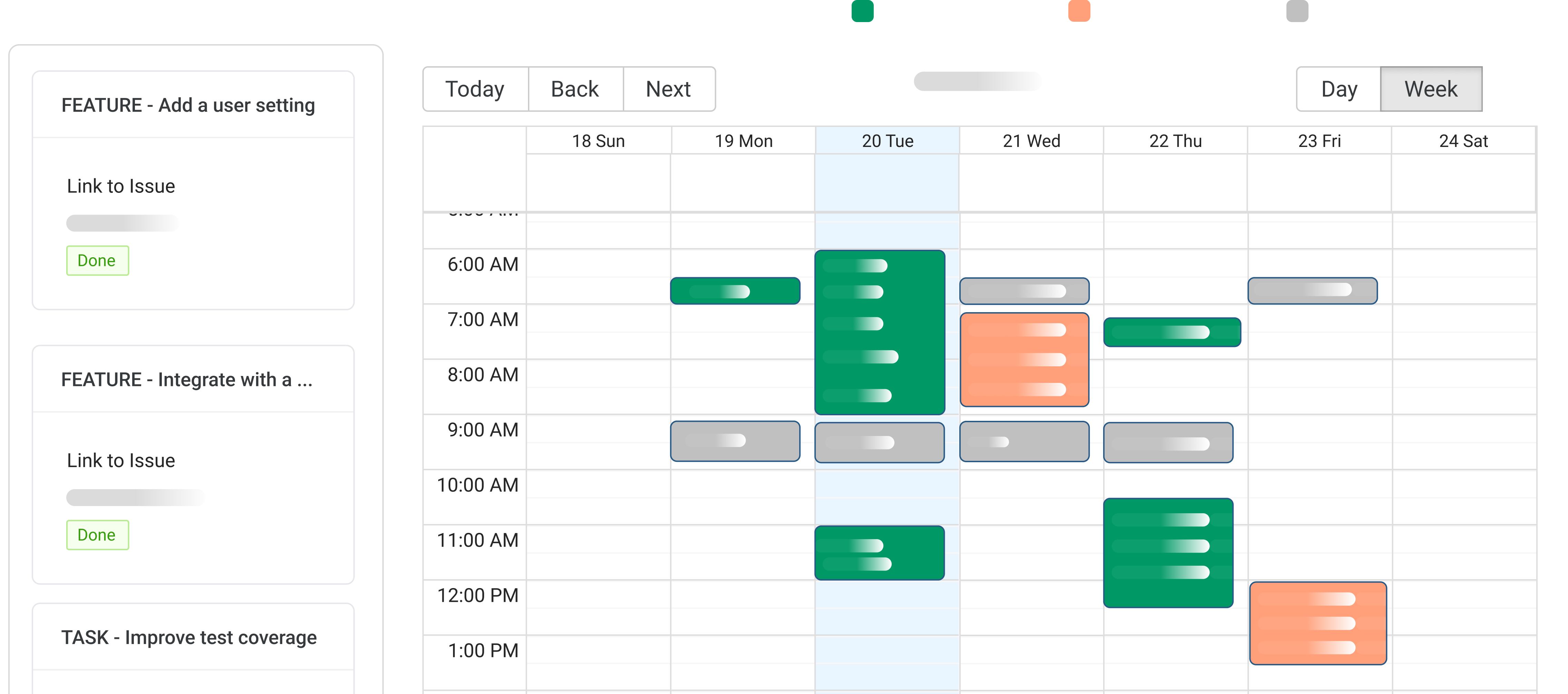

Automated Documentation: Traqqie automates the documentation method by capturing authentic-time facts on R&D things to do, doing away with the need for guide history-retaining.

Comprehensive Compliance: With Traqqie, firms can ensure compliance with WBSO rules as a result of developed-in checks and validations, cutting down the potential risk of errors and penalties.

Effective Reporting: Make precise WBSO stories very easily with Traqqie's intuitive reporting instruments, conserving time and means.

Streamlined Workflow: Traqqie streamlines the entire WBSO administration workflow, from job registration to submission, building the method seamless and hassle-absolutely free.

Benefits of Applying Traqqie for WBSO Administration:

Time Discounts: By automating repetitive duties and simplifying procedures, Traqqie helps enterprises preserve valuable time that could be reinvested into innovation and growth.

Improved Precision: Reduce the risk of glitches and make sure correct WBSO promises with Traqqie's Sophisticated validation mechanisms.

Charge Efficiency: Decrease administrative expenditures associated with WBSO administration and increase the return on your own R&D investments.

Peace of Mind: With Traqqie handling your WBSO administration, you can have satisfaction recognizing that the compliance obligations are increasingly being met successfully.

Conclusion:

Successful WBSO administration is critical for corporations looking to leverage tax incentives to fuel their innovation efforts. With Traqqie, companies can simplify WBSO administration, streamline processes, and make sure compliance easily. Say goodbye for the complexities of WBSO administration and hi to a more effective and successful means of handling your R&D incentives with wbso Traqqie.